7 Smart Strategies for Teaching Teens About Credit

Last Updated on October 4, 2025 by Yadira Bacelic

This post may contain affiliate links, which means I’ll receive a commission if you purchase through my links at no extra cost to you. Please read the full disclosure for more information.

Introduction

“Did you know that 8 in 10 U.S. adults say they would’ve had a better start with money if they had learned more about personal finance in high school?” (Ramsey Solutions)

That statistic stopped me in my tracks — because I was one of them. Nobody taught me how credit worked, and I learned the hard way. I opened my first credit card at 18 just for a free t-shirt, and it led me down a long road of debt I didn’t fully understand.

Years later, after paying off every dollar and living debt-free, I made a promise to myself: my kids would not start their adult lives trapped by credit mistakes. When my daughter recently got her driving permit, she told me she wants to save up for her first car — and pay in cash. She’s also heading to college next year, determined to stay debt-free. That moment reminded me that teaching teens about credit isn’t about fear, it’s about freedom.

If you’ve ever wished you could help your teen make smart financial decisions from the start, you’re in the right place. In this post, I’ll share 7 smart, proven strategies for teaching teens about credit from everyday conversations to hands-on lessons that build real confidence. You’ll learn how to talk about credit scores,

No lectures, no guilt, just simple, practical ways to help your teen step into adulthood with confidence, control, and a clear plan to stay debt-free.

Why Teens Need to Learn About Credit Early

I’ll never forget the first time my daughter asked me, “Mom, why can’t I just use a credit card like you when I want to buy something?” Honestly, I froze. Back then, I didn’t even fully understand what went into a credit score myself. And that’s the danger most of us don’t learn about credit until adulthood, usually after making a mistake that costs way more than it should.

The truth is, teaching teens about credit early is like giving them a cheat code to adulthood. When they know how credit works before they’re 18, they’re less likely to fall into traps like maxing out credit cards or taking on student loans without realizing what the interest really means. Waiting until adulthood often means they learn the hard way through late fees, debt collectors, or that sinking feeling when you get denied for your first apartment.

Credit impacts everyday life more than teens realize. It’s not just about swiping a plastic card. A solid credit score determines whether they can rent their first apartment, buy a car, or even get certain jobs. Some insurance companies check credit scores before setting rates, and landlords almost always do. Without credit knowledge, a teen can quickly find themselves paying more for the same thing or worse, being told “no” altogether.

I’ll give you a real-life example. A friend of mine co-signed a car loan for her son right after he turned 18. He didn’t know that skipping “just one payment” could drop his credit score by 100 points. It took him almost three years to recover from that mistake. That’s why I always tell parents: if you don’t talk about credit at the kitchen table now, life will teach your teen later and it won’t be gentle.

The most common money mistakes teens make without credit education are honestly preventable. They confuse debit and credit, they think minimum payments mean “I’m good,” and they borrow without a plan to repay. I made the same mistakes in college, racking up interest charges I didn’t understand. That’s why I’m passionate about credit education for teens, because I know firsthand how those small choices snowball into years of financial stress.

So here’s the deal: the earlier you start teaching teens financial responsibility with credit, the more control they’ll have. Show them how borrowing really works, explain why paying bills on time matters, and give them simple, relatable examples. Something as small as borrowing $20 from you and “repaying” with interest can spark the lightbulb moment that makes credit real.

It’s not about making them financial experts overnight. It’s about planting seeds of understanding now so they grow into confident young adults later. And honestly, isn’t that what we all want for our kids to step into the world with confidence instead of confusion?

Explaining the Basics of Credit to Teens

If you’ve ever tried explaining what credit actually is to your teen, you’ve probably seen that classic glazed-over look somewhere between polite confusion and “are we done yet?” Credit can sound intimidating, even for adults, but here’s the truth: once you break it down into real-life examples, it starts to make sense fast.

When teaching teens about credit, the goal isn’t to overwhelm them with financial jargon; it’s to help them connect credit to everyday life. Think storytelling, not lecturing. Teens remember lessons that feel real, not theoretical.

Here’s how I start: I tell my teen to imagine borrowing $20 from a friend for lunch. “If you pay them back on time,” I say, “they’ll probably trust you again. But if you don’t, they’ll hesitate next time.” That’s credit plain and simple. It’s borrowing, paying back, and building trust.

Credit cards work the same way. You’re borrowing money from a company instead of a friend. If you pay it off on time and keep your balance low, your credit score, that trust score, goes up. If you miss payments or borrow too much, it goes down. When you frame it that way, teens can actually see how their choices impact their financial future.

One thing that really helped my own kids understand the difference between credit vs. debit was showing them both cards side by side.

- With debit, it’s your money you’re spending what’s in your account.

- With credit, you’re borrowing someone else’s money and promising to repay it.

To make it stick, we did a quick “family money simulation.” I gave my teen $10 of “borrowed money” and charged a pretend $1 interest when they didn’t “pay” me back on time. They laughed at first—but trust me, they got the point. Sometimes a small, hands-on lesson hits harder than any lecture.

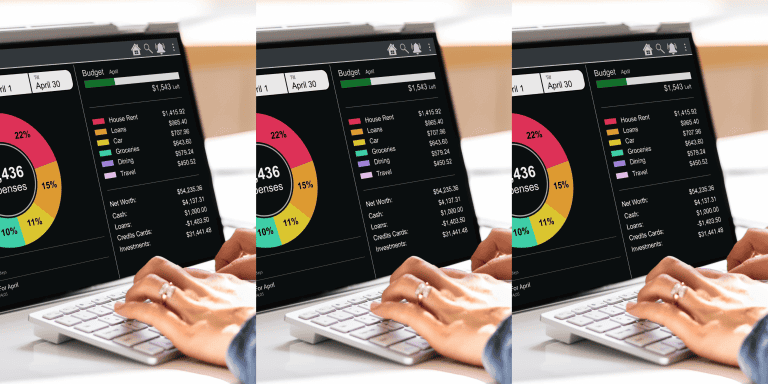

If you want a simple way to build on these conversations, I created a free Teen Budget Tracker that walks families through setting spending limits, saving goals, and even “practice” credit habits. It’s an easy, no-pressure way to start building healthy money routines together. You can grab it anytime on my Free Resources page. It’s one of those tools that makes the “teaching” part a lot easier (and way less awkward).

Ultimately, credit education for teens isn’t about fear it’s about confidence. When your teen understands how borrowing works, they start to see credit as a tool, not a trap. You’re not just teaching them about money you’re giving them lifelong independence.

Credit Scores Made Simple for Teens

Explaining credit scores to a teen can feel a bit like explaining how Wi-Fi works, invisible, complicated, and way too easy to ignore. But if we want our kids to be financially independent, teaching teens about credit has to include showing them what a credit score actually means (and how it follows them everywhere).

I like to start by calling it a “trust score.” It’s a simple way to make it relatable. I’ll tell my teen, “A credit score is just a number that shows how trustworthy you are when you borrow money.” Most teens get that right away. If they pay back what they owe on time, that number goes up. If they don’t, it drops. Simple as that.

Credit scores are usually based on five main factors:

- Payment history (whether bills are paid on time)

- Credit utilization (how much of your available credit you’re using)

- Length of credit history (how long you’ve had accounts open)

- Types of credit (credit cards, loans, etc.)

- New credit inquiries (how often you apply for new credit)

When you show this breakdown visually, it suddenly clicks for teens. It’s one thing to hear that missed payments can hurt a credit score; it’s another thing to see how one late payment can drop a score by 100 points. I learned that lesson the hard way years ago, and I want my kids to learn it the easy way.

If your teen is a visual learner (most are!), this is where my Money Tools & Resources page can really help. I’ve added tools and charts you can print or share, simple visuals that make explaining credit scores way less abstract. Seeing how habits like on-time payments or high balances affect the score helps teens connect their daily actions to long-term results.

To make it more personal, try this: print a blank “mock credit report” from my resources and fill it out together. Create fake scenarios like, “You forgot to pay your bill this month,” or, “You maxed out your card for concert tickets.” Then show how each decision impacts the score. Teens love interactive lessons, and they remember them far better than lectures.

When teaching teens financial responsibility, repetition matters. Keep the conversation ongoing. Once they start grasping how their decisions influence their score, they’ll think twice before borrowing or ignoring a payment reminder.

The goal isn’t to make them obsessed with their credit score; it’s to help them see it as a mirror of their habits. When teens understand that their financial choices build or break that number, they’re already miles ahead of where most adults start.

Credit doesn’t have to be scary. It’s simply a tool, and like any tool, it works best when you know how to use it.

Teaching Responsible Credit Card Use

Let’s be honest, just hearing the words credit card makes a lot of parents nervous. I get it. I’ve been there. I got my first credit card at 18 just for the free t-shirt, and it took me years to dig myself out of debt. So when it comes to teaching teens about credit, my philosophy is simple: teach them money management first, not credit cards.

Here’s why teens don’t need access to a credit card to learn how credit works. What they do need is hands-on experience managing their own money, tracking spending, and understanding how quickly small purchases add up. That’s why I always recommend starting with a checking account and a debit card, not a credit card.

With a debit card, teens get a realistic view of money: when it’s gone, it’s gone. There’s no illusion of “borrowed money.” It helps them see how balance,

When my kids wanted to buy something, we made it a teaching moment. I’d say, “Let’s check your balance first.” That small pause helped them learn to think before spending a skill most adults wish they had learned earlier.

Credit cards can easily make money feel invisible, but debit cards make it tangible. That’s why I haven’t used a credit card in over ten years, and I’ve never looked back. Living debt-free taught me that financial peace comes from knowing exactly where your money is going, not borrowing more of it.

If you want to help your teen start tracking spending, saving for goals, and managing their debit card wisely, my free Teen Budget Tracker can make it easier. It’s a printable tool that helps teens plan where their money goes, practice

At the end of the day, teaching teens financial responsibility isn’t about whether they can handle credit it’s about whether they understand money. The sooner they learn to live within their means, the less likely they’ll ever need to rely on credit later.

Practical Ways Parents Can Teach Credit Responsibility

Here’s the thing: You don’t need fancy spreadsheets or a financial degree to teach your teen how to be responsible with money. In fact, the best lessons usually happen in everyday life. Teaching teens about credit really means helping them understand cause and effect — spend, save, borrow, repay. It’s less about “credit cards” and more about learning how money actually works.

One of the simplest ways to start is by helping your teen open their first checking account with a debit card. This gives them the chance to practice managing money they actually own. Every deposit, every purchase, every little mistake — it all teaches them accountability. It’s much safer (and more realistic) than handing them a credit card.

I like to turn these lessons into small family challenges. For example, give your teen a set allowance for the month and let them decide how to spend and save it. Don’t bail them out if they overspend in week one (as hard as that is!). It’s better they learn from a $20 mistake now than a $2,000 one later.

You can also create little money role-play scenarios at home. Pretend they “missed a bill payment,” or “forgot to transfer money for gas,” and talk through what happens next. These small conversations build big awareness. When they understand that financial decisions have consequences, they start thinking differently.

I’ve also found it helps to keep things visual. That’s where my Money Tools & Resources page comes in handy. I’ve put together easy-to-use printables and guides that help families teach

Because at the end of the day, credit responsibility starts with money awareness. Teens don’t need a credit card to learn self-control; they need practice managing what they already have. Every time they track a purchase, save for something they want, or resist an impulse buy, they’re learning the exact habits that protect them from debt later.

The more you talk about money, the less mysterious it becomes. And when your teen understands how to make smart choices with real money, they won’t just know how credit works they’ll know how to manage life.

Smart Money Habits That Build Strong Credit

One thing I’ve learned after years of being debt-free is this: good credit isn’t about credit cards, it’s about consistent money habits. If you’re teaching teens about credit, the best place to start is with daily actions that build discipline, awareness, and confidence. When teens learn how to manage what they have, they naturally create the foundation for strong credit later in life.

The first (and most powerful) habit? Paying bills on time. Even if your teen doesn’t have “real bills” yet, you can give them simple responsibilities like paying for their streaming service or covering part of their phone plan. The goal isn’t the dollar amount; it’s the routine. When teens connect the dots between deadlines, money, and consequences, they start treating due dates seriously.

Another key habit is keeping balances low not just on cards, but in spending overall. If your teen learns early that it’s okay to wait and save for what they want, you’re teaching patience and financial self-control. Those skills are worth more than any reward points or cash-back offers.

You can make it fun by creating “mini

Another great practice is reviewing statements together. Sit down once a month to look over their debit transactions or digital spending history. Let them talk through what they notice, maybe they were surprised by how much they spent on takeout, or proud of how much they saved. These moments turn awareness into accountability.

And don’t forget the emotional side of money. Talk about how spending and saving make them feel. A big part of financial literacy for teens is helping them understand the “why” behind their choices. If they feel good about

That’s exactly why I created my free Teen Budget Tracker to make these lessons simple and practical. It’s not fancy or complicated; it’s just an easy way to write things down, track habits, and see progress over time. You can print it out and use it together during your “money check-ins.” It’s amazing how much clarity comes from simply putting numbers on paper.

Because the truth is, smart credit doesn’t come from a card, it comes from character. Every time your teen practices saving, paying on time, and managing money intentionally, they’re building trust not just with lenders, but with themselves.

And that, more than any credit score, is what financial freedom really looks like.

How to Prepare Teens for Their First Credit Milestones

There’s something both exciting and a little nerve-wracking about watching your teen take those first big steps into adulthood their first job, their first car, maybe even their first apartment. Each of those milestones comes with financial responsibility, which is why teaching teens about credit goes far beyond credit scores or cards. It’s about helping them handle real-world money with confidence.

Let’s start with that first paycheck. When teens get their first job, they’re thrilled until they see all those deductions. Taxes, Social Security, maybe even health insurance if they’re older. It’s the perfect time to teach them about

If your teen plans to buy a car or rent an apartment one day, this is where good money habits really pay off. Landlords and lenders don’t just look at credit, they look at reliability. A teen who pays their phone bill on time, manages a checking account responsibly, and saves regularly is already building a reputation for financial trustworthiness. That’s the real foundation of strong credit.

When my oldest started their first job, we made a deal: every paycheck, 20% went straight into

As your teen grows, talk about student loans, rent, and utilities before they face them. Explain that a loan is a promise to repay, not free money. Show them how small missed payments can linger for years, and why living within their means keeps them free from stress later. These are conversations I wish I’d had earlier, but now I make sure my kids have them before stepping out on their own.

If you want tools to help guide these talks, check out my Money Tools & Resources page. You’ll find simple worksheets and guides that make it easier to walk your teen through

The truth is, financial milestones aren’t one-time events; they’re stepping-stones. The sooner your teen understands how to handle them, the stronger and more independent they’ll become.

By teaching them to budget their first paycheck, pay bills on time, and save before they spend, you’re not just helping them build credit, you’re helping them build character.

And that’s the kind of credit that never expires.

Conclusion

When my daughter got her driving permit, I had one of those “wow” moments every parent eventually faces. She’s not my little girl anymore — she’s becoming an adult, making her own choices, and thinking about her future in ways that make me proud.

The first thing she told me after passing her test was, “Mom, I want to save up and buy my first car in cash. I don’t want to owe anyone anything.” That stopped me in my tracks. Because that right there — that mindset — is the whole reason teaching teens about credit matters.

She’s learning that freedom doesn’t come from being able to borrow; it comes from managing what you already have wisely. She’ll be heading to college next year, and she’s already planning to stay debt-free — no credit cards, no unnecessary loans, just smart saving and thoughtful spending. Watching her take ownership of her finances has been one of my proudest mom moments.

And it reminded me of something simple but true: our kids are always watching how we handle money. They listen to what we say, sure, but they learn even more from what we do. Every time we talk openly about

If you want to start those same conversations at home, you don’t need to overcomplicate it. My free Teen Budget Tracker is a great place to begin. It’s a simple one-page printable to help teens set goals, plan

And when you’re ready to go deeper, my Money Tools & Resources page has more family-friendly tools to help teach financial confidence at every stage from first jobs to first apartments.

At the end of the day, credit isn’t really about plastic cards or three-digit scores. It’s about character, choices, and confidence. When we give our teens the tools to manage money wisely, we’re not just helping them avoid debt; we’re giving them a head start on living free, independent, and empowered lives.

So celebrate those moments, the first job, the first

Other Posts You May Like

Teen Financial Literacy in 2025: A Complete Guide for Parents, Educators, and Teens

9 Common Teen Money Mistakes (and How to Help Your Teen Avoid Them)