5 Essential Ways of Budgeting Your Money (That Will Instantly Make Life Easier)

Last Updated on August 27, 2025 by Yadira Bacelic

This post may contain affiliate links. Please read the full disclosure for more information.

Introduction

The idea of

In this post, I’m sharing 5 essential ways of

1. Track All of Your Income

The first step in

Your paycheck(s)

Spouse or partner’s paycheck

Part-time jobs or freelance gigs

Side hustles or extra earnings

Any additional income (like bonuses, tips, or even a garage sale)

Once everything is listed, add it all up to find your total monthly income after taxes. This number will guide every step of your budget.

💡 Pro Tip: Use a budget planner, notebook, or app, whichever system feels easiest for you. The best budget is the one you’ll actually stick with.

2. List All of Your Expenses (Including Debts)

Next, it’s time to get honest about where your money goes. Look at your bank statements or receipts to make sure you’re capturing every expense. Common categories include:

Housing (rent or mortgage, HOA fees)

Utilities (water, gas, electricity, internet)

Food (groceries, dining out)

Transportation (gas, tolls, bus/train passes)

Insurance (health, auto, life)

Childcare or education costs

Medical bills

Clothing

Debt payments (credit cards, student loans, car loan, etc.)

Entertainment & fun money

Some expenses are fixed (like rent), while others fluctuate (like groceries). Don’t forget to include debts list them all, from smallest to largest.

💡 Pro Tip: Try the cash envelope system for variable categories like groceries or fun money. Once the cash is gone, that category is closed until next month super effective for staying on track.

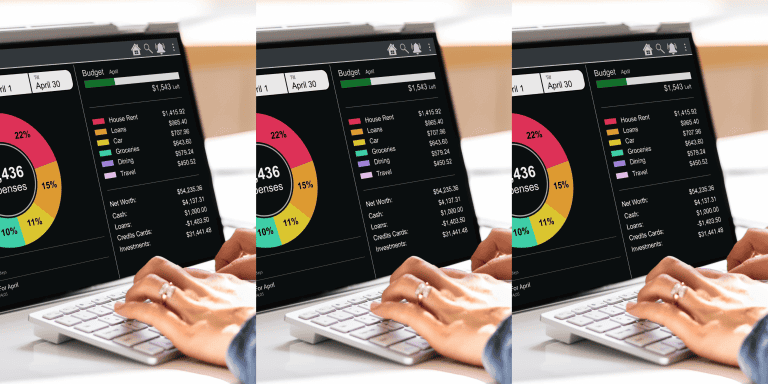

3. Subtract Expenses From Income (Zero-Based Budgeting )

Here’s where

The goal is to give every dollar a job, whether that’s covering bills, saving, or paying off debt. This is called zero-based

That doesn’t mean you’re broke, it means you’re in control. If you have leftover money, assign it to

4. Set Money Goals That Motivate You

A budget isn’t just about paying bills—it’s about building the life you want. Once your basics are covered, set financial goals that excite and motivate you.

Ask yourself:

Do I want to pay off debt faster?

Do I need to build an emergency fund?

Am I saving for a vacation, house down payment, or college?

Start small and realistic. Instead of aiming for $5,000 all at once, break it down: “I’ll save $500 this month.” These mini goals add up and keep you motivated.

📚 Helpful resource: “The Total Money Makeover” by Dave Ramsey is a great read if you need step-by-step strategies for building momentum.

Once you’ve finished

5. Review Your Budget Regularly

Here’s the secret: your budget isn’t a one-and-done plan. Life changes, unexpected bills, extra income, or shifting priorities happen all the time. That’s why checking in on your budget is crucial.

I recommend spending a few minutes daily tracking purchases and updating your categories. This habit will:

Stop overspending before it gets out of hand

Show you what’s left for the month

Help you adjust categories if needed

Keep you moving toward your goals

Budgeting your money gets easier the more consistent you are; it becomes second nature over time.

Final Thoughts on Budgeting Your Money

Think of your budget as your personal roadmap. It helps you steer your money with purpose instead of letting it control you. And just like learning any new skill, it takes practice, usually about 3–4 months, to really feel comfortable.

There will be mistakes, surprises, and adjustments along the way, but that’s okay. Every small step builds confidence and brings you closer to financial peace.

At the end of the day,

So start today, give yourself grace, and stick with it. You’ll be amazed at how much easier life feels when your money finally works for you.

✨ Next Step: Want a head start? Download my free Teen Budget Tracker to practice smart money habits, or check out my Money Tools & Resources page for planners and side hustle ideas that can help you stay on track.

Other Posts You May Like

Teen Financial Literacy in 2026: A Complete Guide For Raising Financially Confident Teens

15 Best Money Apps for Teens in 2025: Smart Tools Every Teen Should Know About