Teen Emergency Fund: Why Every Teen Needs One and How Parents Can Help Build It

Last Updated on September 3, 2025 by Yadira Bacelic

This post may contain affiliate links, which means I’ll receive a commission if you purchase through my links at no extra cost to you. Please read the full disclosure for more information.

Introduction

Did you know that according to the Federal Reserve’s 2024 “Economic Well-Being of U.S. Households” report, nearly 37% of Americans can’t cover a $400 emergency expense without borrowing, selling something, or falling behind on bills? That’s a staggering number, and it’s exactly why teaching kids smart money habits early is so important. Helping your child build a teen emergency fund gives them confidence, independence, and financial resilience long before adulthood.

In this guide, we’ll break down what an emergency

What Is a Teen Emergency Fund?

When we talk about a teen emergency fund, we’re not talking about thousands of dollars tucked away in a bank. For teenagers, it’s much simpler than that. It’s just a small pot of money saved intentionally that’s set aside only for true emergencies. Think of it like a safety net your teen creates for themselves, not for pizza nights, not for the latest sneakers, but for the moments when life throws them a curveball.

For teens, an emergency might be something as basic as needing to replace a broken phone that’s essential for school communication, covering a surprise fee for a field trip, or even chipping in on household essentials if your family hits a tough patch. (I learned this lesson firsthand when my dad was laid off and I was able to help with groceries thanks to my own little rainy day fund.) Those moments are stressful, but having money set aside gives teens a sense of control and independence.

The difference between an emergency

Even if your teen rolls their eyes at the word “fund,” the first time they cover a real emergency with their own

Why Teens Need an Emergency Fund

I didn’t even know what a teen emergency fund was when I was growing up. Back then, I just called mine a “rainy day fund.” I saved a little here and there from babysitting and summer youth program paychecks. At first, I thought it was just extra money for fun. But when my dad was laid off and money was tight at home, I was able to step in and cover the groceries one month. It wasn’t a lot, but it mattered. And it taught me early on that having money set aside for emergencies isn’t optional, it’s essential.

That’s the heart of why your teen needs their own emergency

Even a small fund, like $100 or $200, changes how teens view money. They realize, “I can handle this.” And when they don’t have to run to you for every unexpected expense, it gives them a sense of responsibility that sticks. Of course, they’ll need guidance too — teens are experts at convincing themselves that concert tickets or trendy sneakers are “emergencies.” That’s where you step in as a parent, setting clear boundaries together. Write down examples of real emergencies so they know what qualifies and what doesn’t.

Once they understand the “why,” the next question usually comes up pretty quickly: how much should a teen actually save in their emergency fund?

How Much Should a Teen Save in Their Emergency Fund?

One of the most common questions I hear from parents is, “How much should my teen really save?” The good news is, it doesn’t have to be complicated. A teen emergency fund should start small and grow in stages. When I was a teenager, my babysitting money and summer youth program paychecks weren’t big, but I still made it a habit to put aside a little. Even $10 here or $20 there added up. And when my family hit a tough time during my dad’s layoff, that rainy day money gave me the ability to contribute. That moment showed me that small

For teens, a good first milestone is $100. Once they reach that, aim for $500. Eventually, the goal could be one month of their basic expenses, things like gas money, phone bills, or school supplies. The key is that your teen sees progress along the way. Celebrating small wins keeps them motivated and helps them feel like saving is achievable instead of overwhelming.

Parents can make this easier by connecting

Of course, teens might feel discouraged when they see friends spending freely while they’re saving. That’s where your encouragement makes all the difference. Remind them that their teen

Now that you know how much your teen should save, the next step is figuring out the best ways to help them get started without feeling overwhelmed.

Best Ways for Teens to Start an Emergency Fund

Now that you’ve talked with your teen about why an emergency fund matters and how much to save, the big question is: how do they actually start? The truth is, getting started doesn’t have to be complicated. The best way to help your teen build a teen emergency fund is to make saving feel simple and achievable, not like a chore.

One of the easiest starting points is opening a teen-friendly

Another great way to build an emergency

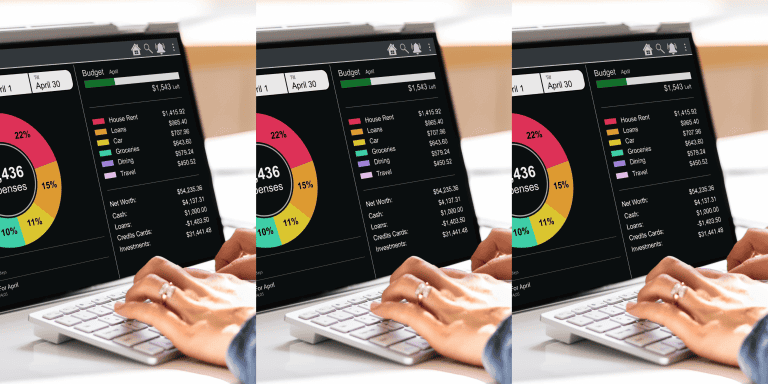

Don’t overlook the power of technology either. There are budgeting apps for teens that allow them to track income and set

Parents can also set up accountability systems. Maybe you agree to match their contributions up to a certain amount, almost like an employer match on a 401(k). Or you could create a family “challenge,” where everyone tries to save a small set amount each week. Making it a shared experience helps teens feel supported rather than singled out.

What matters most is that your teen takes that first step. Whether it’s putting the first $20 bill into an envelope or opening their very first bank account, that small action shifts how they see money. Once the ball is rolling, the pride of watching their emergency fund grow becomes its own reward. And before long, your teen will not only have a little financial cushion, but also the confidence to know they can handle life’s unexpected surprises.

Saving doesn’t always have to feel serious, though. In fact, some of the best results come when teens make it fun. That’s why I love encouraging saving challenges and creative strategies to keep the momentum going.

Fun & Easy Saving Strategies for Teens

Here’s the thing about teens: if saving feels boring or restrictive, they’ll tune it out. But when saving feels like a challenge or even a game, suddenly they’re on board. The good news is, there are plenty of fun and creative ways to help your child build their teen emergency fund without it feeling like a punishment.

One strategy I love is the “round-up” method. Many teen-friendly apps allow purchases to be rounded up to the nearest dollar, with the spare change going directly into

Saving challenges are another great option. For example, try the $5 challenge: every time your teen gets a $5 bill, they set it aside. Or set a weekly challenge, like saving $10 every Sunday. If your teen is motivated by visuals, give them a

Side hustles are also a game-changer. Babysitting, pet sitting, tutoring, mowing lawns, these “micro-jobs” give teens ownership of their money and teach them responsibility. When my own rainy day fund started, it came from babysitting and summer youth program paychecks. And because I worked for it, I was more motivated to protect it. Encourage your teen to take pride in setting aside a portion of their hard-earned income for their emergency fund.

Parents can make saving fun by turning it into a family event. Maybe everyone saves $20 a month and tracks progress on a chart together. Or create an accountability group with siblings or friends, where they celebrate hitting new milestones. Teenagers thrive on community and encouragement, so why not tap into that when teaching smart money habits?

The goal isn’t to make your teen feel deprived. It’s to show them that saving for emergencies doesn’t mean they can’t enjoy life. With the right approach, saving can actually feel empowering, like they’re leveling up in real life. And when they realize their teen emergency fund gives them the freedom to handle life’s surprises without panic, they’ll see the value of every single dollar they set aside.

Of course, fun strategies are just the beginning. To make sure these habits stick, it’s important to go deeper, teaching your teen the “why” behind saving and modeling smart money habits at home. A tool like the free Teen Budget Tracker makes it easy for your teen to see progress toward goals like $100, $500, or one month of expenses. Visual trackers keep teens motivated and honestly, they love coloring in those boxes.

Teaching Teens About Smart Money Habits

At the end of the day, an emergency fund isn’t just about money; it’s about teaching life skills. Your teen may not realize it now, but the habits they form in high school will follow them into adulthood. When parents take the time to guide their kids through building a teen emergency fund, they’re really teaching responsibility, independence, and self-confidence.

One of the best ways to make this stick is by modeling the behavior yourself. If your teen sees you using your own emergency

Another way to build smart money habits for teens is by making goal-setting part of the process. Have your child set two goals: one fun (like saving for a trip or new tech) and one practical (building their emergency fund). This balance teaches them the difference between saving for wants and preparing for needs. Pair it with tools like a teen spending tracker or even printable charts, so they can visually track their progress. Kids respond so well when they can literally see their

Don’t be afraid to involve them in real family conversations, either. If a medical bill comes up or the budget feels tight one month, talk (in age-appropriate terms) about how your family handles it. These small moments give teens context and show them why an emergency

And here’s a little tip I’ve learned along the way: celebrate their wins, even the tiny ones. If they save their first $50, cheer them on. If they resist dipping into their emergency fund for a non-essential, acknowledge their discipline. Those little nudges of encouragement are what keep teens motivated and proud of themselves.

By teaching your teen smart money habits now, you’re giving them something far more valuable than just dollars in an account. You’re giving them confidence to handle life’s ups and downs with resilience. And of course, part of that lesson is learning from mistakes, which brings us to one of the most overlooked parts of this journey.

Common Mistakes Teens Make with Emergency Funds

Now, let’s be real, even the most well-meaning teens are going to make mistakes with their money. And honestly, that’s okay. Mistakes are part of learning. The important thing is to catch them early and use those moments as teaching opportunities. When it comes to a teen emergency fund, there are a few common slip-ups that almost every parent will see at some point.

The first big one? Using the fund for non-emergencies. Teens are creative; they can convince themselves that concert tickets, fast food runs, or the latest sneakers absolutely qualify as “urgent.” I’ve seen it happen more than once. This is why it’s so important to set clear guidelines together. Make a list with your child: broken glasses? Yes. Surprise school fees? Yes. Shopping spree because of a sale? Nope. Having this written out helps eliminate the gray area when temptation strikes.

Another common mistake is mixing their emergency

Some teens also get discouraged if their balance isn’t growing fast enough. They think, “What’s the point of saving $5 here or $10 there? It’ll never add up.” This is where your encouragement matters most. Remind them that slow progress is still progress, and small deposits do add up over time. Share your own experiences, like how babysitting money or summer job paychecks slowly built into something meaningful. Teens often need to hear that steady effort is normal, not failure.

And here’s one that parents sometimes overlook: guilt. Some teens feel guilty dipping into their teen emergency fund even when it’s a true emergency. They’ve worked so hard to save that they don’t want to see the number go down. Reassure them that this is exactly what the money is for, covering the unexpected and saving them from stress later. If they use it for the right reasons, they’ve done it correctly.

At the end of the day, the mistakes aren’t the problem. It’s whether your teen learns from them. With your guidance, they’ll quickly understand the difference between wants and needs, the value of keeping money separate, and the importance of consistency. And once they’ve worked through those lessons, they’ll be ready to not just save but thrive.

Conclusion

By now, you can see that helping your child build a teen emergency fund is about so much more than money. It’s about confidence, responsibility, and giving them a taste of independence in a safe and supportive way. Whether they’re saving from babysitting jobs, a summer youth program, or a small allowance, the habit of setting aside money for unexpected expenses will serve them for years to come.

As parents, we know life rarely goes according to plan. Teaching your teen to prepare for rainy days now ensures they won’t be blindsided later. Even if their fund starts small — $50, $100, or $500, it’s the consistency that matters. Each deposit reinforces the lesson that their future self is worth planning for. And when the day comes that your teen pays for a broken laptop, a surprise school expense, or even helps out at home during a tough season, you’ll see just how powerful that little fund can be.

Most of all, remember that this journey isn’t about perfection. Your teen will make mistakes, they’ll spend when they shouldn’t, get discouraged, or feel tempted. That’s okay. With your encouragement, those slip-ups become lessons that stick. And as they practice setting goals, separating wants from needs, and protecting their emergency

So here’s your call to action: start the conversation today. Sit down with your teen and explain what an emergency fund is, why it matters, and how much to aim for. Help them open that first account or set up an envelope system. Celebrate their progress, no matter how small. You’re not just teaching them to save money, you’re giving them tools for financial independence, resilience, and peace of mind.

And if you’d like a little extra support, grab our free Teen Budget Tracker. It’s a simple, fun tool to help your teen set

Other Posts You May Like

15 Best Money Apps for Teens in 2025: Smart Tools Every Teen Should Know About

Teen Financial Literacy in 2025: A Complete Guide for Parents, Educators, and Teens