11 Teen Online Shopping Tips: How to Shop Smart, Safe, and On Budget

Last Updated on November 18, 2025 by Yadira Bacelic

This post may contain affiliate links, which means I’ll receive a commission if you purchase through my links at no extra cost to you. Please read the full disclosure for more information.

Introduction

My daughter has always been the thoughtful spender in our house the kind of teen who compares prices, checks reviews, and refuses to buy anything without making sure it’s truly worth the money. So when she walked over the other day with her phone in hand, I knew it had to be something she genuinely cared about.

She had found her favorite wall plug-ins on sale and was excited… but still cautious. Before hitting checkout, I asked her the same questions I always ask: “Are we actually running out? And is this really the best price compared to other stores or past sales?”

She didn’t roll her eyes or brush it off. Instead, she took a few minutes to research, checking previous sale prices, comparing similar products, and even verifying shipping costs. In the end, she was proud to show me that this really was the best deal, it came with free shipping, and the sale deadline was approaching.

Moments like that remind me that even the most responsible teens still need guidance, especially in a world where online shopping is constant, fast, and sometimes overwhelming. It’s exactly why I love sharing teen online shopping tips with other parents because helping our kids build smart, confident buying habits has become such an important part of raising financially savvy young adults.

1. Teen Online Shopping Tips They Need More Than Ever

Even though my daughter is naturally thoughtful with her money, I see how different the online world looks for teens today. Shopping isn’t something they plan for, it’s something that finds them as they scroll. Between TikTok Shop deals, Amazon lightning sales, fast-fashion apps, and influencers showing “must-haves” every day, teens are surrounded by nonstop buying temptations that didn’t exist when we were growing up.

And while responsible teens can navigate a lot on their own, even they can run into things like:

- Confusing return policies

- Hidden fees

- Misleading reviews

- Sites that look legit but aren’t

It isn’t just about avoiding overspending; it’s about helping them understand a digital marketplace that moves fast and isn’t always transparent. When we teach teens how to pause, compare, verify, and think through their purchases, we’re giving them tools they’ll carry into adulthood, long after the trends fade.

You can read more about how we built this habit in the Teen Spending Tracker post

2. Compare Prices Before Buying

A few days after the plug-in sale, my daughter told me she now compares prices almost automatically, a habit that pays off more than teens realize. With how quickly deals pop up online, taking even a minute to compare can be the difference between saving money and losing it.

2.1 Use price-check tools

I like to show her how simple it is to check prices across different stores using free tools like Honey, Google Shopping, or Capital One Shopping. Teens love fast answers, and these tools give them a quick visual of where the real deal actually is.

2.2 Look for coupon codes

One of the easiest habits to build is teaching teens to search:

“brand + coupon code”

right before checkout.

It takes seconds but often uncovers discounts they wouldn’t see otherwise.

2.3 Check shipping time and return fees

This is where many teens accidentally overspend. A “cheap” item can become expensive once they notice:

- Shipping fees

- Return charges

- Slow shipping

- Minimum purchase requirements

Helping them look past the price tag builds both confidence and long-term money awareness.

For more guidance on helping teens avoid financial slip-ups, the Teen Money Mistakes post breaks it all down.

3. Read Reviews (Real Ones Only)

In our home, reading reviews is almost like the final step before making any online purchase. My daughter and I don’t sit and go through them together from the start, we each like doing our own digging first. She researches the item, compares prices, checks the product details, and watches videos of people using it. I do the same on my end. Then we circle back and chat about what we found, almost like comparing notes.

This little routine has helped her build a strong sense of independence and judgment. She learns how to evaluate information on her own, and then we talk through anything that feels off or too good to be true. It’s a simple habit, but it gives teens a structure to follow before they commit their money to something.

3.1 Spotting Fake Reviews

One thing I always remind her is that not all reviews are honest. Some are paid, some are copied, and some are written to boost a product that isn’t actually great. When she finishes her research, I encourage her to look for reviews that have real details, not just “Love it!” or “Amazing product!”

If a review doesn’t explain why the person liked or disliked something, we treat it as background noise. Reviews that mention specific features, quality, or experiences tend to be more trustworthy. And when several reviews are written in a similar style with the same short phrases? That’s usually a sign to dig deeper.

3.2 Look for Real Photos + Real Customer Videos

Both of us love watching short unboxing or “real use” videos, because that’s where the truth shows up. Photos or videos from actual customers tell a story that the brand’s polished images don’t:

How big the item really is.

Whether the color matches the description.

How it performs in everyday use.

My daughter is visual, so these details help her decide if something feels worth her money or if the excitement came only from the marketing.

3.3 Check Low-Star Reviews First

After we’ve done our digging, we always skim the low-star reviews. Not because we’re expecting disappointment, but because that’s where the honest experiences usually hide. This part helps my daughter weigh the risks: Was the issue rare, or did multiple people mention it?

Talking through these reviews helps her think critically:

Is this problem a deal-breaker?

Is it something she can accept?

If your teen doesn’t have an emergency fund yet, this guide explains how to help them build one.

4. Watch Out for Scams & Unsafe Sites

Even responsible teens can get caught off guard online because some websites are designed to look trustworthy at first glance. My daughter and I talk a lot about this not to scare her, but to help her feel confident when shopping somewhere new. Online scams don’t always look dramatic or obvious; sometimes they’re just missing information, unclear policies, or checkout pages that aren’t secure.

I always remind her that safe online shopping is not about being afraid it’s about being aware. A few quick checks can protect her money, her privacy, and her personal information.

4.1 Red flags: no HTTPS, no clear return policy, unrealistic or inconsistent pricing

Here are the real, widely recognized red flags that experts recommend looking for:

- No HTTPS

A secure site should show a lock icon in the address bar. If the site doesn’t use HTTPS, information sent through the page (like your name, address, or payment info) is not encrypted. This is a very basic safety standard. - No clear return policy

Legitimate retailers clearly list their return process, timelines, and requirements. If a site hides this information or has no policy at all, it’s a strong sign to avoid buying. - Prices that don’t match average market value

Extremely low prices compared to similar retailers can indicate counterfeits, dropshipping delays, or items that never arrive. Teens don’t need to memorize prices they just need to notice when something feels unusually cheap.

These aren’t scare tactics they’re simple indicators that cybersecurity experts consistently teach.

4.2 How to verify a site is legit

There are a few safe, realistic ways to check whether an online store is trustworthy:

- Search the brand name with words like “reviews,” “store review,” or “return policy.”

- Look for the store on Google Maps or business directories if they claim to have a physical location.

- Check their About and Contact pages stores should list an email, physical location, or customer service method.

- See if they have an active social media presence that shows real customers commenting or tagging the brand.

None of this guarantees perfection, but it helps teens avoid sites that have no history or track record.

4.3 When teens should never enter personal information

This is one of the most important rules my daughter follows:

Never enter any personal or payment information on a site that:

- Doesn’t use HTTPS

- Has pop-ups asking for unusual details (like birthdate or ID numbers)

- Redirects to an unfamiliar checkout page

- Has many customer complaints about orders never arriving

- Looks incomplete, glitchy, or poorly translated

These patterns are recognized by consumer protection agencies as signs of unsafe or low-quality online stores.

I always tell her:

“If something feels rushed or confusing, stop. A safe store won’t pressure you.”

Smart shopping isn’t just about getting a deal it’s about protecting your money and your information.

For more guidance on helping teens avoid financial slip-ups, the Teen Money Mistakes post breaks it all down.

5. Stick to a Spending Limit

My daughter has always been very responsible with her money, but even responsible teens need time to adjust as their financial world changes. When she was younger, she earned money weekly what we called her “commission,” based on chores and responsibilities. She got used to

But once she got older, we shifted everything to a monthly stipend instead. That transition was a big learning moment. Suddenly, she had to think ahead, pace her spending, and stretch her money across the entire month. It took practice, but it helped her understand what real-world

That’s why sticking to a spending limit matters so much. It gives teens structure, but it also teaches them how to plan, how to slow down, and how to make choices that align with their goals.

5.1 Create a Shopping Budget

Before my daughter buys anything, she checks her budget for the month. Not because she’s unsure but because she’s learned that money lasts longer when you give it direction. Weekly money disappears quickly, but monthly

Having a set shopping amount gives teens independence. They don’t have to ask if every purchase is “okay.” They just need to stay within the boundary they set.

5.2 Add Items to the Cart and Wait 24 Hours

One habit that helped her the most during the monthly transition was the 24-hour rule. If she finds something she likes online, she adds it to her cart and walks away.

This pause helps her decide if she wants the item or if she just liked the idea of it in the moment. Most of the time, she still wants it and moves forward confidently. Other times, she forgets about it, which tells us it wasn’t that important after all.

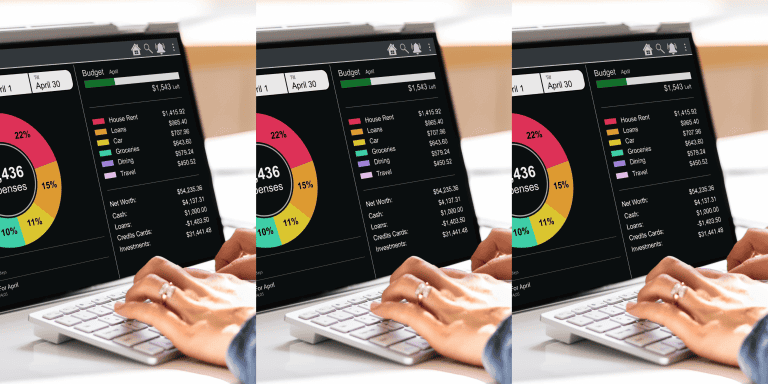

5.3 Use a Spending Tracker

Tracking her purchases each month is what truly helped everything click. It showed her where her money was going, how fast it moved, and which habits were helping or hurting her budget. Seeing the numbers gave her a stronger sense of control.

You can download my free Teen Budget Tracker; it’s the same simple tool I use to help teens understand where their money is going each month.

6. Create a Wish List Instead of Buying Fast

One thing that really helped my daughter adjust from weekly “commission” pay to a monthly stipend was learning how to pause before buying. When money comes in weekly, it feels like there’s always something new on the way. But with monthly

Now, whenever she finds something she likes online, she saves it to a wish list first. It lets her hold onto the excitement without committing to the purchase. She gets to revisit the item later with a clearer mind and a better understanding of how it fits into her budget. And I love this habit because it teaches the exact skill we want teens to build: delayed decision-making rather than delayed gratification.

A wish list gives teens breathing room. It removes that “I need to buy this right now” feeling that online shopping often triggers. Instead, it becomes part of a thoughtful process where they can compare similar items, notice price changes, read more reviews, or simply decide that the item doesn’t matter as much the next day.

6.1 Why Wish Lists Reduce Impulse Buying

Wish lists are a simple system that naturally slows teens down. When my daughter adds something to hers, she’s giving herself time to think… and that time makes all the difference. It gives her a chance to ask:

- Do I still want this tomorrow?

- Will I use it more than once?

- Does it fit into my monthly budget?

Most teens don’t need to stop shopping; they simply need a moment of space between wanting something and buying it. A wish list creates that space.

6.2 How to Prioritize Wants vs. Needs

Another thing I’ve noticed is that wish lists help teens understand the difference between wanting something and truly needing it. When my daughter looks at her list after a few days, certain items stand out while others fade into the background. This natural sorting process helps her see what she values most.

Sometimes she even ranks her wish list items by priority, especially when she’s saving for something bigger like her long-term goals or her car

If your teen is saving for a big goal, like a car, this guide walks them through creating a plan they’ll actually stick to.

7. Choose Secure Payment Methods

As my daughter became more confident shopping online, one thing I wanted her to understand early on was that how she pays is just as important as where she shops. Because even responsible teens can run into unexpected issues — an incorrect charge, a package that never arrives, or a vendor that isn’t as reliable as they seemed.

And since our family doesn’t use credit cards, we focus on ways to protect her debit card information while also preparing her with a small emergency fund for those “just in case” moments. That safety net gives her confidence knowing she can handle surprises without panic or dipping into money meant for something else.

7.1 Why Debit Cards Need Extra Caution Online

A debit card pulls money from her account immediately, which means she feels every dollar as it leaves. That’s a great financial lesson — but it also means she needs to be careful. If something goes wrong, even with fraud protection, it can take a few days for the money to be returned.

So I remind her that using a debit card online is perfectly fine as long as she uses it through safe platforms and keeps her emergency fund topped up. That way, she’s never thrown off by delays in refunds or unexpected charges.

7.2 Use Virtual Debit Cards or Teen-Safe Apps (Step, Greenlight)

To add an extra layer of protection, she uses virtual debit cards through apps like Step or Greenlight. These apps allow her to:

- Use a secure, temporary card number

- Set spending limits

- Monitor activity

- Freeze the card instantly if something feels off

This lets her shop independently without exposing her real card information everywhere. And if an issue pops up, she knows her emergency fund can cover the temporary gap.

7.3 Use Secure Digital Wallets (Apple Pay, Google Pay)

Whenever possible, I encourage her to pay with Apple Pay or Google Pay because they never share her actual card number with the store. Instead, they use tokenization a secure, encrypted code so even if a merchant is hacked, her real information stays protected.

Digital wallets also require Face ID, Touch ID, or a passcode, which adds another layer of safety without adding complexity.

I tell her:

“Using a digital wallet protects your information. Keeping an emergency fund protects your peace of mind.”

Together, secure payment methods + an emergency cushion make online shopping safe, responsible, and stress-free.

For more on preparing teens for the unexpected, see the Teen Emergency Fund article.

8. Understand Return Policies Before Buying

One of the biggest lessons my daughter learned about online shopping came from a phone case she ordered last year. The website photos made it look sturdy and high-quality, but when it arrived, it looked nothing like what she expected thin, flimsy, and not at all like the product image. Naturally, she wanted to return it. That’s when she discovered the company charged a return fee… something she hadn’t noticed beforehand.

She was frustrated at first, but instead of giving up, she reached out to customer service. She explained that the product she received didn’t match the photos, and thankfully the company agreed to send her a replacement at no charge. It turned out to be a good outcome, but it also taught her a valuable lesson: always read the return policy before buying anything online.

Since then, checking return policies has become a part of her routine not because she expects something to go wrong, but because she now understands how different every store can be. And that small habit saves teens from a lot of accidental spending.

8.1 Why Teens Lose Money on Returns

Many teens assume returns are simple: you send it back, they refund you, and that’s it. But as my daughter learned, return fees can quickly turn a cheap purchase into an expensive mistake. Some companies charge shipping, others deduct a restocking fee, and some don’t allow returns at all.

Her phone-case situation opened her eyes to how quickly those costs add up. Even responsible, thoughtful shoppers can be caught off guard when they don’t review the fine print first.

8.2 What to Look For in Return Policies

To help her avoid surprises, I taught her to check a few key things before she buys:

- Return window: Is it 7, 15, or 30 days?

- Return cost: Free, flat fee, or customer-paid shipping?

- Refund type: Money back or store credit?

- Restocking fees: Some stores take a percentage of the refund.

- Item condition: Must tags be attached? Must packaging be unopened?

These small details help teens make smarter decisions before they commit.

8.3 The Screenshot & Deadline Tracking Method

Now, whenever she shops online, she takes a quick screenshot of the return policy or the order summary. If she ever needs to return something, all the important information is right there.

She also adds the return deadline to her phone calendar a simple trick that prevents missed windows and unnecessary spending.

Her phone-case experience turned into a priceless lesson: reading return policies isn’t boring fine print it’s part of protecting your money.

9. Don’t Get Tricked by Influencer Pressure

Even though my daughter is naturally thoughtful with her money, she’s still a teen and teens live in a world where influencers make everything look irresistible. Sometimes it’s a room makeover video, sometimes a “must-have” accessory, sometimes a skincare routine that promises miracles. And even responsible teens can feel that tiny tug: “Everyone has this… maybe I should get it too.”

I’ve seen it happen in small ways. She’ll show me a product that’s suddenly all over her feed, and we’ll talk about where she first saw it. Nine times out of ten, it started with an influencer video that made it look trendy, useful, or absolutely life-changing. And while she’s good at spotting exaggeration, the constant exposure can still make something seem more valuable than it really is.

I remind her often that influencers aren’t always sharing because they genuinely love something sometimes they’re sharing because they’re paid to promote it. That doesn’t automatically make the product bad, but it does mean teens should pause before buying.

9.1 FOMO Spending Patterns and Trends

One thing I’ve taught her is to recognize the feeling behind the urge to buy.

If the thought is,

“Everyone else seems to have this,”

then it’s probably a FOMO (fear of missing out) purchase not a truly needed one.

Trends move fast, especially online. What’s popular this month might be forgotten in a few weeks. Helping teens recognize emotional triggers like FOMO gives them the confidence to step back and decide based on value, not hype.

9.2 Ads Disguised as Product Reviews

This is one of the trickiest things for teens. Some influencer videos look like honest reviews but are actually sponsored content. The lighting, the excitement, the carefully placed camera angles, it’s all designed to sell.

I tell my daughter to ask herself:

“Is this person reviewing the item, or advertising it?”

If the video seems overly positive, lacks real detail, or avoids mentioning downsides, it’s usually a sign that it’s more ad than review.

9.3 A Simple Checklist Teens Can Use Before Buying

To help her stay grounded, I showed her a quick three-question checklist:

- Do I want this because I’ve seen it everywhere?

- Would I still want it if no one else had it?

- Does it fit into my budget and my actual needs?

She uses this all the time now, and it helps her feel in control rather than influenced.

Influencers can inspire, but they shouldn’t decide how teens spend their money. If you want more examples of common pitfalls, I explain them in my Teen Money Mistakes article.

10. Separate Wants vs Needs

One of the most important skills my daughter learned when she shifted from weekly commission money to a monthly stipend was understanding the difference between wanting something and genuinely needing it. When she was younger, weekly money made decisions feel simpler if she had the cash, she spent it. But with a monthly budget, she quickly realized she had to make choices, and that meant thinking a little deeper about each purchase.

Sometimes she still comes to me excited about something she found online, and instead of saying “yes” or “no,” I’ll ask:

“Is this something you want right now, or something you’ll still want in a few weeks?”

Those kinds of questions help her slow down and think about whether an item really fits into her goals, her budget, and her lifestyle.

Learning to separate wants from needs isn’t about limiting teens; it’s about helping them understand themselves and make thoughtful decisions.

10.1 Quick Decision Checklist

To help her evaluate purchases, we created a simple checklist she can run through in less than a minute:

- Will I use this more than once?

If the excitement is about the trend or the novelty, it’s likely a want. - Does this replace something I already have?

If she already has something similar that works well, it’s probably not a need. - Will buying this get in the way of other goals?

Especially now that she’sbudgeting monthly and saving for bigger things like her car, this question keeps her grounded. - Would I buy this even if it wasn’t on sale?

Sales are great, but they shouldn’t drive the decision.

These tiny checkpoints help her focus on value instead of emotion, and I’ve seen her become more confident in her choices because of it.

10.2 Avoid Trend-Based Overspending

Teens today see trends move at lightning speed what’s popular on TikTok this month might disappear next month. My daughter learned early on that chasing trends drains her budget quickly. Instead of buying something because “everyone has it,” she asks whether it actually fits her needs or long-term plans.

She’s told me more than once, “I’m glad I waited I don’t even want that anymore.”

That’s the power of slowing down.

Teaching teens to look past trends and focus on what really matters helps them develop strong, lifelong money habits. It’s not about saying no it’s about helping them choose wisely.

For a deeper look at building responsible money habits, see the Teaching Teens About Credit guide.

11. Track Every Purchase

When my daughter switched from weekly commissions to a monthly stipend, one of the biggest eye-openers for her was how quickly “little things” added up. At first, she felt like her money disappeared faster than she expected, not because she was overspending, but because she wasn’t keeping track of the smaller purchases sprinkled throughout the month.

We didn’t make it complicated. I simply told her, “Let’s start writing everything down so you can see your spending instead of guessing.” The first month she tracked, she noticed patterns right away. Suddenly,

Tracking purchases is one of the simplest but most powerful parts of teen financial literacy. It helps them understand themselves, not just their money.

11.1 Use a Simple Printable or App (Updated)

Teens don’t need a fancy system they need something they’ll use consistently. My daughter started by writing things down on paper because it felt more real than logging it on her phone. Later, she switched to a simple digital version because it matched her routine better.

If your teen prefers something hands-on, I also created a Teen Budget Binder Kit that gives them a simple place to stay organized.

11.2 Why Tracking Helps Teens Build Money Awareness

Teens often think they know where their money is going, but they don’t until they actually track it. My daughter had moments where she said, “I didn’t realize I spent that much on small things!” Tracking helped her see her habits clearly, which made adjusting them much easier.

It also builds confidence. When teens can look back at their month and understand their decisions, they start making choices based on awareness instead of guessing. That awareness is what leads to financial maturity.

11.3 Weekly Review Routine (With Parent or Guardian)

Once a week usually Sunday evenings we sit together for just a few minutes and review her spending. Not as a lecture, and not to criticize. It’s more like a calm check-in:

“What worked this week?”

“What didn’t?”

“What do you want to do differently next week?”

These conversations help her stay grounded and give her space to ask questions without pressure. It’s a small routine, but it builds strong habits and keeps money conversations healthy and open.

Tracking isn’t about perfection it’s about awareness. And for teens, that awareness becomes a lifelong skill.

If your teen learns best with tangible tools, the Teen Budget Binder Kit can help them stay motivated and consistent.

12. Final Thoughts

Teaching teens how to shop online is one of those modern parenting skills none of us expected to need but it’s becoming just as important as teaching them how to save, budget, or compare prices at the store. Watching my daughter grow into a thoughtful, confident shopper has shown me how powerful these small lessons can be. It’s not about controlling their spending it’s about giving them the tools to make smart, independent choices as the digital world keeps changing.

These teen online shopping tips help teens pause, evaluate, compare, and decide with clarity instead of pressure. When they understand how to spot scams, read real reviews, check return policies, and track their spending, they start to feel capable and empowered. And honestly, that’s the end goal: raising teens who can trust themselves with money.

If your teen is just getting started with

And if you want to explore more of the tools I rely on as a parent teaching financial literacy, you can find them on my Money Tools & Resources page, where I share the things that have supported us along the way.

Helping teens shop smart online isn’t about perfection. It’s about progress, awareness, and conversations that build lifelong habits. And every step you take with them matters.

Other Posts You May Like

Teen Financial Literacy in 2026: A Complete Guide For Raising Financially Confident Teens